BRP HOT TOPICS

Data Protection, ESG, Cryptos

DATA

PROTECTION

Banks and individuals have a strong interest in the protection of their data being respected and secured. Information about the financial situation of a person is among the most sensitive forms of personal data

Financial institutions need to implement a pragmatic, yet compliant programme to secure personal data and respect both the Swiss Federal Data Protection act and the banking legislation

Data protection is an evolving legal matter

Regular training of employees, careful review of internal processes and transparency of processing can lower the risks of data breaches and misuse of valuable information

WHAT ARE YOUR Questions?

BRP SA is here to assist you in managing data protection matters related to the banking industry

click on the icon to discover the answers

Questions

you are asking yourself

BRP SA is here to assist you in managing data protection matters related to the banking industry

ON DATA PROTECTION

The new Federal Act on Data Protection (Art. 14) requires companies located abroad to appoint a Swiss Data Protection Representative

Financial institutions can also decide to appoint voluntarily a Data Protection Representative to offer its clients a first point of contact in Switzerland

- Do you have clients in Switzerland and your company is based abroad?

- Do you process their personal data?

- You don’t have a registered office in Switzerland?

-

- We act as the local, accessible point of contact for Swiss data subjects and for the FDPIC

- We offer our local languages skills

- We register before the FDPIC

- We provide our deep knowledge in the Swiss legislation

- We maintain your records of processing activities

Find out from us whether you need this solution to comply with Swiss legislation

Want to know more about Data Protection and Privacy?

Talk to our BRP experts

esg

The possible diversity of ESG and the high level of complexity of the issues make it difficult to address in a relevant way from a regulatory point of view. Sustainable finance faces a huge challenge for its evolution: the absence (yet) of commonly recognised international standards

ESG INVOLVEMENT

LISTED COMPANIES

&

FINANCIAL INTERMEDIARIES

Climate change

Emissions

Biodiversity

Energy efficiency

Resource depletion

FINANCIAL SERVICES

&

PRODUCTS

Human rights

Health and safety

Diversity, equity and inclusion (DEI)

Conflict zones and conflict minerals

Community engagement

GOVERNANCE

Executive independence and structure

Conflicts of interest

Anti-money laundering and corruption

Responsible tax strategy

Stakeholder engagement

global standard

Recently (on 26 June 2023), the ISSB, an independent board established by the International Financial Reporting Standards (IFRS) Foundation, released its first global sustainability disclosure standards. The ISSB standards are built on the concepts that underpin the IFRS Accounting Standards, which are used by more than 140 jurisdictions

for ESG implementation

- For both listed companies and financial intermediaries, particular emphasis is placed on the need for greater transparency on sustainable criteria with regard to the public and investors

- Financial services and products need to incorporate ESG (environmental, social and governance) criteria into their business and investment decisions

- Financial service providers needs to integrate ESG preferences and ESG risks into investment advice and portfolio management

- Among the key areas to be considered are the question of specific resources and their integration into management processes, information for target customers and employee training

- An effort to make the offers, processes and measures understandable for customers and regulators to avoid greenwashing

Want to know more about ESG?

Talk to our BRP experts

why cryptos?

Recent significant events, including the bankruptcy of FTX, have underscored the need for regulatory oversight in this rapidly growing sector. Recognizing the magnitude of this phenomenon, regulators and supervisors worldwide have begun to implement laws and regulations pertaining to the issuance and registration of crypto-assets. A prime example of this regulatory response is the European Union’s Markets in Crypto-Assets (MiCA) regulation

Consequently, businesses operating in this sector must familiarize themselves with the specific regulations of the countries in which they intend to offer their services and products. Furthermore, they must ensure they have the necessary resources to maintain compliance with these regulations

RELEVANT ISSUES

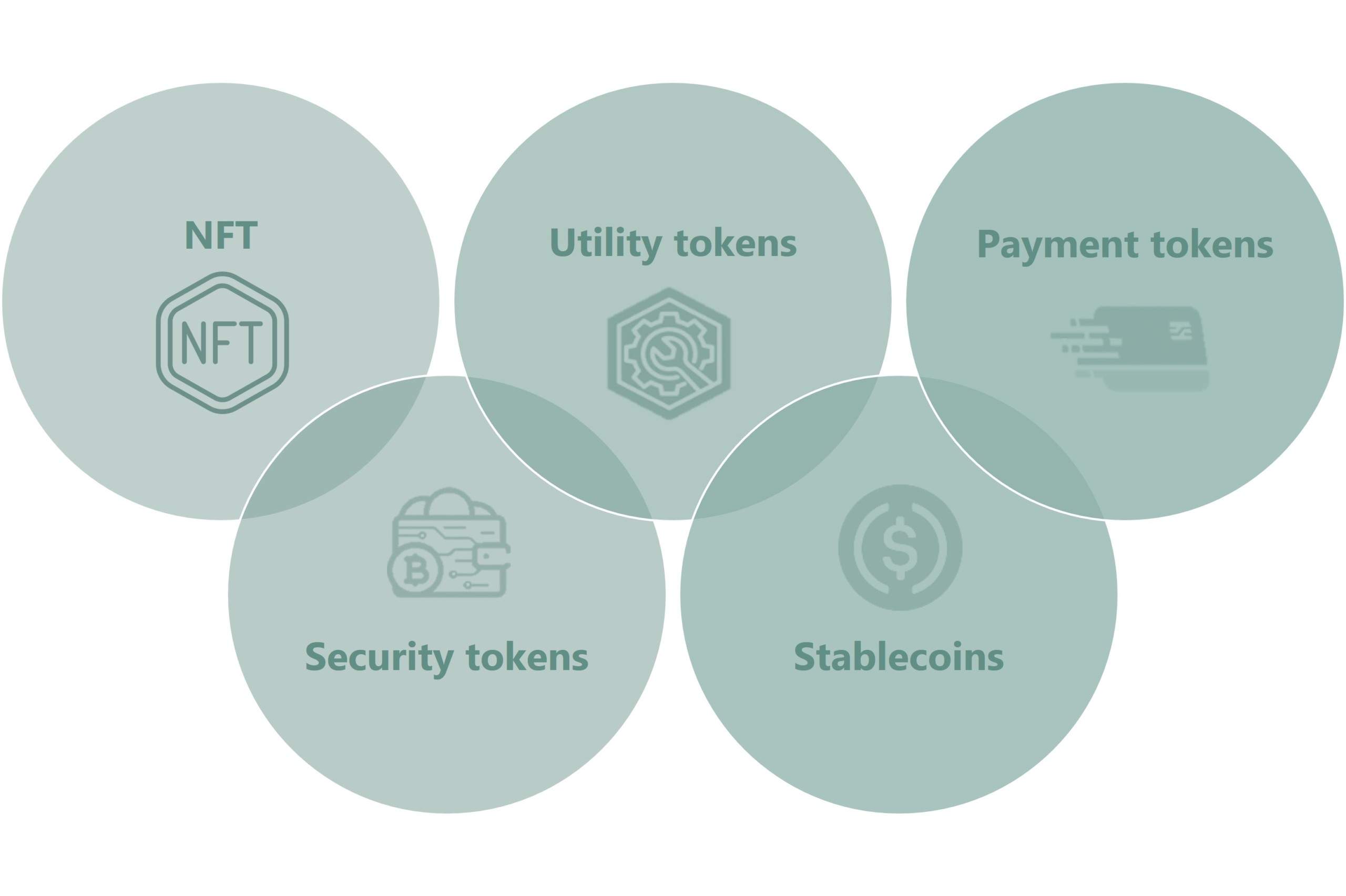

Classification of crypto-assets

qualify a crypto-asset in the correct class(es)

PAYMENT

TOKENS

SECURITY

TOKENS

UTILITY

TOKENS

STABLECOINS

N F T

DISTRIBUTION

Determine whether the crypto-asset itself

must be registered in order to be distributed to the public

LICENSE

Determine whether a crypto-service

is subject to a licence

and under which conditions

ADVERTISING

PROSPECTING

TRADING / EXCHANGE

PLATFORM

CUSTODY

SERVICES

STACKING

ADVISORY

AGREEMENT

DISCRETIONARY

ASSET MANAGEMENT

EXCEPTIONS TO LICENSE AND REGISTRATION

What current banking and investment practices are

recognized (or tolerated) by the authorities?

Reverse solicitation

&